最近几年,随着中国企业在非洲的投资急速上升,国际舆论的怀疑言论也越来越多。在欧盟布鲁塞尔的一个会议上,组织者请我谈谈中国在非投资企业的社会责任问题,以及对欧盟的国际发展政策有何启示。

这反映出欧盟的两个意图。一方面,欧盟意识到欧美传统的对非发展政策并不成功,似乎需要学习中国模式,即:中国政府支持的以基础设施、直接投资为先导的发展援助政策。另一方面,欧盟担心中国投资者在非洲不能承担必要的社会责任,不利于非洲发展。

光有批评性的言论是不够的,我们需要建设性的方案。基于布鲁塞尔大会的发言,我和联合国的梁国勇博士一起撰文,分析了中国对非洲投资的背景和趋势,探讨了中国公司在企业社会责任方面的进展和面临的主要挑战。作者认为欧盟和中国可以在以下领域开展积极合作:有针对性的高级培训,欧洲和新兴经济体在非洲投资的企业社会责任案例库,国际性标准和协会向中国企业开放,就以下专门的议题开展超出意识形态的技术性研究,比如在非洲经济特区的效益和环境评估、非洲工人权益和灵活性、如何改进非洲的投资环境、促进多国组合投资等。

原文及链接如下。发表于Trade Negotiations Insights, 由日内瓦的国际贸易和可持续发展中心和海牙的欧盟发展管理政策中心联合出版。

Social responsibility of Chinese investment in Africa: What does it mean for EU-China Cooperation on development policy towards Africa?

by Shuaihua Cheng & Guoyong Liang

Over recent decades, most Western companies have been looking at and then moving to emerging economies where business is perceived to be more profitable and less risky than investing in Africa.

China, on the contrary, have and will continue to investing in Africa, against the background of closer economic ties between China and African countries. According to a forecast from South Africa’s Standard Bank- Africa’s largest lender- Chinese investment into Africa may rise by 70 per cent to US$50 billion by 2015 from 2009 and bilateral trade between China and Africa would reach US$300 billion by 2015.

In this dramatically contrasting context, China’s investment in Africa has drawn a lot of attention. On the one hand, it is recognized that Chinese investment has contributed to Africa’s economic growth, trade and employment. On the other hand, questions are raised on how to maximise the development impacts of Chinese investment in Africa, taking into consideration job creation, increasing incomes, gender equity and the environment.

This article will focus on one critical issue in this context: the social responsibility of Chinese investment in Africa and the implications for development policies of the EU towards Africa.

Current landscape of Chinese investment in Africa

Bilateral trade between China and Africa has risen by more than 30 per cent for eight consecutive years, surpassing US$100 billion in 2008. After a modest setback in 2009 due to the global financial crisis, bilateral trade jumped to US$ 127 billion in 2010, making China a leading trading partner of Africa. In parallel of the deepening trade relationship supported by proactive policies of the Chinese government, investment by Chinese companies in Africa has increased substantially.

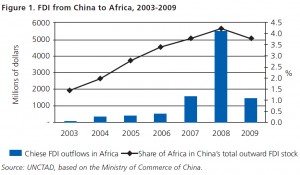

China’s foreign direct investment (FDI) outflows to Africa rose rapidly from 2003 to 2008, though dropped significantly in 2009.(1) As a result, Chinese FDI stock in Africa reached US$9.3 billion by the end of 2009, accounting for 3.8 per cent of China’s total outward FDI stock (figure 1).

The leading African recipient of FDI from China is South Africa (representing a quarter of total Chinese FDI stock in the whole African continent), followed by Nigeria (with a stock of US$1.03 billion), Zambia, Algeria, Sudan, Democratic Republic of Congo, Egypt, Ethiopia, Tanzania and Mauritius (US$243 million).

In terms of the industry breakdown of Chinese FDI in Africa, establishing a precisely quantified evaluation is hindered by data limitation. Available information indicates a high share of FDI in extractive industries, driven by the resources-seeking efforts of Chinese oil and mining companies. However, the total number of projects in other industries is large, and the substantial industrial restructuring taking place in China can be expected to lead to increased FDI in manufacturing in Africa. (2)

The supply-side

There are several driving forces behind the surge of Chinese investment in Africa.

Undoubtedly the Chinese government has played a critical role in encouraging Chinese companies to invest in Africa. First, China works with African host countries to improve investment climate and by the end of 2010, the country has concluded bilateral investment promotion and protection agreements with 33 African countries along with agreements to avoid dual taxation with 11 African countries. Secondly, China set up the China Africa Development Fund (CADF), an equity fund dedicated to supporting Chinese investors in Africa.(3) Thirdly, drawing from its own experience, China promotes industrial parks, also called Special Economic Development Zones, in Africa. China has invested US$250 million in infrastructure in 6 industrial parks as planned in Zambia, Mauritius, Nigeria, Egypt and Ethiopia. It is reported that the industrial park in Zambia as the first such one invested by China overseas has utilised US$600 million and created over 6000 local jobs.

The demand side

Booming Chinese investment in Africa is not just one-way wishful thinking from the Chinese side. From the demand side perspective, many African host countries are fond of Chinese investors who are believed to have the following competitive advantages in comparison to traditional investors:

- Chinese businesses, notably in the sectors of construction and information technology services, normally offer low cost technology and bring skilled workers who are willing to work in difficult environments.

- Instead of a piecemeal project, Chinese investors are able to provide end-to-end solutions combining transportation, energy generation, resources extraction and refining.

- Most Chinese investors have access to long term capital due in part to Chinese government supportive policy.

- Some African leaders appreciate the China model of economic cooperation and development assistance that features high effectiveness, low administrative costs, mutual respect, keeping promise and non-conditionality.

For these reasons Africa welcomes Chinese investors. Such sentiments are echoed by internationally independent scholars, such as Brautigam(4) who highlights three ‘gifts’ that Chinese investors bring to Africa: China’s own experience that aid is not central to development; putting infrastructure at the centre of Chinese aid and investment; and rebalancing the image of Africa as a continent of hope and opportunity (in contrast with the West’s eye-rolling malaise). (5)

Social responsibility of Chinese investment

Corporate social responsibility (CSR) is the concept that enterprises can and should meet “triple bottom lines” (6) of economic growth, environmental soundness and social progress.

CSR of Chinese business starts from governmental response to irresponsible performance of enterprises within the domestic market. In the wake of seemingly non-stop scandals of environmental disaster and poisonous food around the country, Chinese civil society and government have urged the business community to take their legal and moral responsibilities more seriously. Two regulatory documents are milestones in the CSR movement in China. The Corporation Law of China, which was implemented in January 2006, provides the legal foundation of CSR stating that corporations are obliged to take social responsibility. There is also the Guidelines for Central State-Owned-Enterprises (SOEs) regarding Implementation of Corporate Social Responsibility (issued in January 2008) which requires SOEs to establish the necessary mechanisms to fulfil CSR so as to “be human-oriented, stick to scientific development, be responsible to stakeholders and environment, so as to achieve the harmony between enterprises’ growth, society and environment.”

Apart from governmental regulations, pressures from their business partners, investors and local concerns have played a critical role in pushing forward Chinese business to incorporate CSR into business strategy. At home, media investigation (such as Southern Weekend) and grassroots movements led by local environmental NGOs have grown more vocal and influential. In 2009, the Shanghai Stock Exchange announced its CSR Index ; in 2011, in partnership with China Business News, the China Industrial Bank launched an Index for Socially Responsible Investment. A group of Chinese business leaders has also set up an Entrepreneurs Club (Zhongguo Qiyejia Julebu) whose primary objective is to build “Green Companies.”

Apart from external regulations and pressures, a handful of successful companies are advocating CSR proactively, in particular companies operating internationally (as they are the most exposed to international CSR debates and CSR standards compliance). Some such companies are concerned that their business is suffering from reputation penalties simply because other Chinese companies are involved in various scandals. In 2010, 471 publicly listed Chinese companies published their CSR reports. At the time of this article, 181 Chinese companies have joined UN Global Compact and 4 Chinese financial institutions joined the UNEP Finance Initiative on sustainable banking.

Here are two examples of taking social responsibility of Chinese investors in Africa. Since its first project in Africa in 1997, Huawei Technology has hired over 65 per cent of its total staff from Africa, having created over 10,000 jobs indirectly. Huawei also set up 6 training centres across the continent providing training to 12,000 African engineers and workers every year. Sinohydro invested US$900 million in 30 projects in Angola including hydro power, agriculture, hospitals, schools and transportation. It has trained and employed over 8200 local workers.

In spite of progressive achievements in the past decade, there are four major challenges faced by Chinese enterprises.

- The strategic importance of CSR is not always acknowledged in both headquarters and subsidiaries in Africa resulting in shortage of capacity to incorporate CSR into corporate management. Rather than being placed in the core part of corporate strategic management, in many Chinese companies, the CSR department is marginalised. Some business leaders mistakenly view CSR as a form of public relations. This is particularly challenging for emerging private firms (in comparison with big SOEs that normally have more human and financial resources).

- Although some Chinese companies have good knowledge and strategic planning with regard to CSR, their evaluation system is not sufficient to ensure that frontline managers fulfil long term social responsibility in their daily practices, both in terms of internal responsibility and external impact. Even for those senior managers in local operations, performance scores for promotion are based on the short-term financial performances, regardless of ecological and social performance unless scandals occur. There is less incentive among local staff to take social responsibility when weighed against earning more revenue.

- The Chinese culture that encourages “actions speak louder than words” sometimes becomes an excuse for Chinese managers not to engage with civil society, media and local community. It is essential for Chinese investors in Africa to know that, for a corporate citizenship, the process of broader partnership and sense of participation are at least as important as final output itself. Words with local stakeholders about what you have done and what you would like to do are valuable actions that are needed.

- Chinese companies participate in sectoral standards in the areas of responsible investment. Investing in countries where environmental and social regulations are rather loose may reduce compliance costs, but may increase business risks in the long run. For this reason it is important for Chinese investors in Africa to line up with those leading companies in certain regions or sectors in setting standards and helping shape development landscape through peer learning and collaborations.

Largely because of these challenges, some critical issues have not been sufficiently taken into account by Chinese enterprises and their stakeholders. There are notably two priority issues. The first one concerns the sustainable management of national resources, with advocates of resources patriotism suggesting that Chinese investors should try to increase added value to local economies rather than grabbing natural resources in an unsustainable way.

The second thorny issue is employing local workers. Chinese investors are expected to create jobs for the local economy, however many Chinese companies, prefer using Chinese employees for administrative efficiency, even if it means flying in a Chinese worker with the same level of qualification. Based on interviews with various Chinese business leaders, Chinese entrepreneurs are concerned with the lack of flexibility of African workers and high standards of labour laws. It seems there is a need for compromise between Chinese investors and local stakeholders

Implications for EU-China cooperation on development policies towards Africa

Social responsibility of Chinese businesses in Africa is becoming an increasingly important topic in today’s debate about international development. This is a coin with two intriguing sides. The one side being that the traditional public aid model for African development taken by Western Europe is challenged in terms of effectiveness. Would the Chinese model featured with state-supported investment offer something new for European’s international development policies? The other side is that Chinese investors in Africa are faced with major problems of accountability to deliver development outcomes. Would it be feasible to combine European experience of public aid and Chinese private money so as to maximize the development impacts of Chinese investment in Africa?

Europe and China could certainly work together to improve the development approach of Chinese investment in Africa in four ways:

First, the EU and China can join hands to enhance the capacity of Chinese investors in Africa on CSR, notably by providing training to senior managers (with emphasis on the nature of CSR and its implementation, evaluation, partnership-building etc). It would be strategic to provide such training for future leaders. These people are first generation of frontline practitioners in Africa and have both Chinese corporate roots and African experiences. They will become senior managers at the corporate level and shape the long term development landscape in Africa.

Secondly, the establishment of a case study bank of CSR in Africa, comprising CSR stories of European, Chinese, Brazilian and Indian firms would be of value addition. The case study bank of CSR will facilitate experience sharing and spread out best practices, which will encourage and empower Chinese investors to continuously improve their CSR performance.

Thirdly, more opportunities should be provided to Chinese investors to get involved in sectoral discussions on CSR related international standards. Due to cultural, linguistic and sometimes ideological barriers, Chinese companies are not actively engaged in international standard discussions. In the meantime, many international standards coalitions remain a “Western club” style, not so open to newcomers. Therefore, a new way of engagement among private sectors for the development objective is ultimately needed.

Finally, a cross-country public private partnership on project-based cooperation will be an effective entry point. Two principles for this kind of cooperation are 1) the project is technical, without ideological discussion, 2) the project is demand-driven and beneficial for the local community, Chinese investors and European development policy. One example can be a case study and performance enhancement of CSR in Chinese invested industrial parks. It can cover all the above mentioned issues of trade and financial performance, ecological industrial parks, labour standards and work ethics, improving investment climate, engagement with local community, civil society and media.

Conclusion

Social responsibility of Chinese investment in Africa is a phenomenon worth studying because it poses both opportunities and challenges for development in Africa. Lessons can be drawn for Europe’s reflection about the ineffectiveness of their development policies in the past decades.

While they have made progress in fulfilling their social responsibility in Africa, Chinese investors are faced with major challenges to deliver development outcomes as much as possible, particularly in bridging the gap between knowledge of CSR and the mechanism to implement it, as well as overcoming the lack of experience in engaging with local communities and setting international standards.

In this context, Europe and China can initiate effective cooperation to maximise development impacts of Chinese investment in Africa. Conducting targeted training for capacity building, establishing a case study bank for experience sharing, facilitating Chinese investors participation in international discussions of CSR and relevant standards setting, and working jointly on selected practical projects such as that on CSR of Chinese invested industrial park, could all be potential options to enhance cooperation for the benefit of all.

Authors :

Dr. Shuaihua CHENG is Strategic Analysis and China Programme Officer at ICTSD and Dr Guoyong Liang is Economic Affairs Officer, Division on Investment and Enterprise, United Nations Conference on Trade and Development (UNCTAD)

1 The Ministry of Commerce of China established a statistical system for outward FDI (OFDI) on a balance-of-payments basis in 2002. Therefore, reliable and comparable data on Chinese OFDI are available from 2003 onwards.

2 In 2009, for instance two Chinese companies, Daheng Holdings Group and Touch International Holdings Group, invested US$52 in textile manufacturing factory in Botswana.

3 With US$ 1 billion in the phase one, CADF has invested over 30 projects in agriculture, machinery manufacturing, electricity, construction materials, industrial park and port logistics. The Fund will be increased to US$5 billion

4 Deborah Brautigam (2009). The Dragon’s Gift: the Real Story of China in Africa, Oxford University Press.

5 Deborah Brautigam: Three Gifts China Brings to Africa,

6 The phrase of “triple bottom lines” was coined by John Elkington in his 1998 book Cannibals with Forks: the Triple Bottom Line of 21st Century Business.

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号